“Africa is a potential market for the export of Chinese buses.”

“On the way to overseas market, Africa market is no doubt the best gateway for Chinese vehicle manufacturers.”

“Chinese vehicles have very good cost performance. Therefore, compared with European or American counterparts, even Japanese or Korean counterparts, Chinese vehicles are more competitive.”

Insiders from the industry often mention the above words when they are talking about the African market.

As the world's second continent, Africa has nearly one billion people, accounting for 15 percent of the world’s total. The overall GDP reached USD2.572 trillion, USD2, 975 per capita. The trade between Africa and China has seen a tenfold increase since 2001. In 2008, the Chinese trade amount with Africa reached USD 100 billion, taking up four percent of the total African GDP. The market size is quite impressive, and many international institutions are becoming increasingly interested in the economic modernization of emerging African countries.

Especially in 2013, the auto sales volume in African market reached 1,000,000 units. In the next ten years, the development potential of the African auto market may be comparable with that of South America. However, the auto industry in Africa is very backward, largely depending on auto imports. Chinese vehicles are suitable for African users due to their good cost performance, ride comfort and appealing appearance. Therefore, Chinese autos exported to Africa have obvious competitive advantages. Relying on the vast market potential in Africa, China's auto industry has made some achievements. In the future, Chinese auto makers will accomplish more in Africa. “To Chinese bus builders, Africa is a land full of chance,” people from the industry of China said.

Since the imbalanced economic development of the African market, there are many uncertain factors for bus exports. In addition, although public transport services are available in many urban areas of Africa, overloading situation can usually be seen in public city buses and private minibuses. In some areas, poor driving skills and bad road conditions also become the hidden risk of the public transport.

Because of the market potential and stern reality in Africa, Chinese buses exported to Africa must be modified in order to fit the tough operating environment, like reducing the engine emissions, increasing the ground clearance and reinforcing the vehicle body, so as to extend the service life to the maximum while ensuring the safety. Yutong always conducts the new bus development in accordance with the above criteria, like the ZK6120D1 to be launched to the African market.

Besides the suitable product, we also need to have suitable sales method. We sell not only products, but also ideas. We should do some modification in marketing way. Nowadays, African countries attach great importance to FDI and offer preferential policies and tariffs to foreign investors of auto industry. And Chinese auto manufacturers began to increase the investment in Africa for localization. For the exports of CBU buses to Africa, the prices will become very high when taking the freight, custom duty, tax and dealer’s margin into account, which decrease the competitive ability of Chinese products in the local market. It is suggested that we should modify the marketing method step by step from selling products to localization when we choose to sell products as the first step. So the conclusion is that we need to have the suitable products with suitable selling ways, which will increase our sales volume and competition in the African market in the future.

There are many ways to choose, such as localization in Africa. The best way is to choose a country or market in which the international auto brands can’t monopolize under inadequate competition, such as South Africa. In South Africa, the concentration of international brands is insufficient which provides chances for Chinese auto manufacturers.

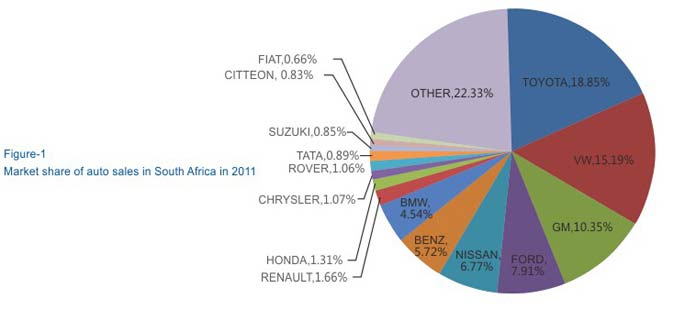

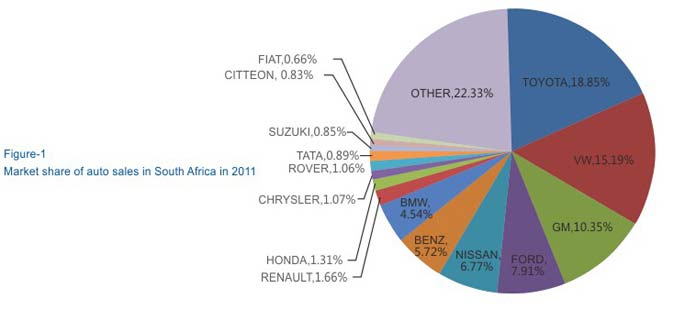

In South Africa, the market share of auto sales in 2011 is indicated as figure-1. The No. 1, TOYOTA took up only 18.85% of the country’s total sales. So there is still chance for Chinese counterparts, since TOYOTA entered the market early in 1961. The competition is not so fierce.

For Chinese auto manufacturers, the GW has invested USD 1.5 million for its 78 dealers’ outlets, and BAIC has set up the JV with IDC to assemble mini buses with an investment of nearly USD 7 million and an annual production capacity of 9,400 units. Although the steps of Chinese auto manufacturers are a little slow, they are exploring the market in South Africa at least.

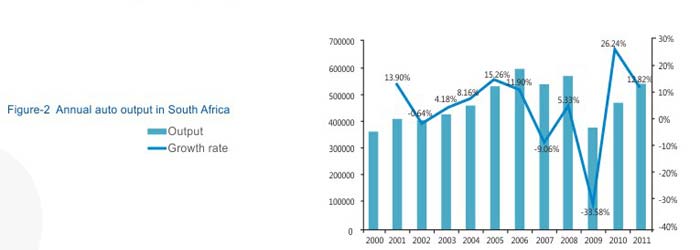

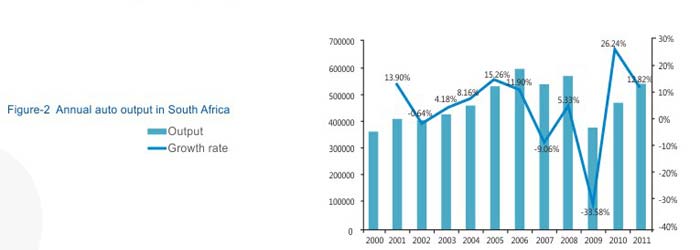

In South Africa, the annual auto output is nearly 600,000 units which means that the auto ancillary industry is relatively complete.

According to the experience of multinational enterprises, from pure trade to step-by-step localization is an inevitable process for the innovation of development modes and increase of market share. This is also a trend in the industry. Of course, the important premise is large-scale production capacity, reliability of products, after-sales service, spare parts supply and so on. Therefore, how can the large enterprises like Yutong deepen the localization and explore new relationships with customers based on the traditional marketing ideas and existing advantages is also an important issue which needs to be faced in the future.

E-bus

E-bus  E-coach

E-coach  City bus

City bus  Coach

Coach  Airfield bus

Airfield bus  Special vehicle

Special vehicle